Calculators

- Navigate

- Click on the content list below

to skip ahead to the different sections

on this page -

Loan Repayments Calculator

-

Interest Only Repayments

-

Total Costs

-

Refinance

-

Income

-

Mortgage Insurance

On the Calculators page, you have access to the following calculators:

- Loan Repayments

- Total Costs

- Refinance

- Income

- Mortgage Insurance.

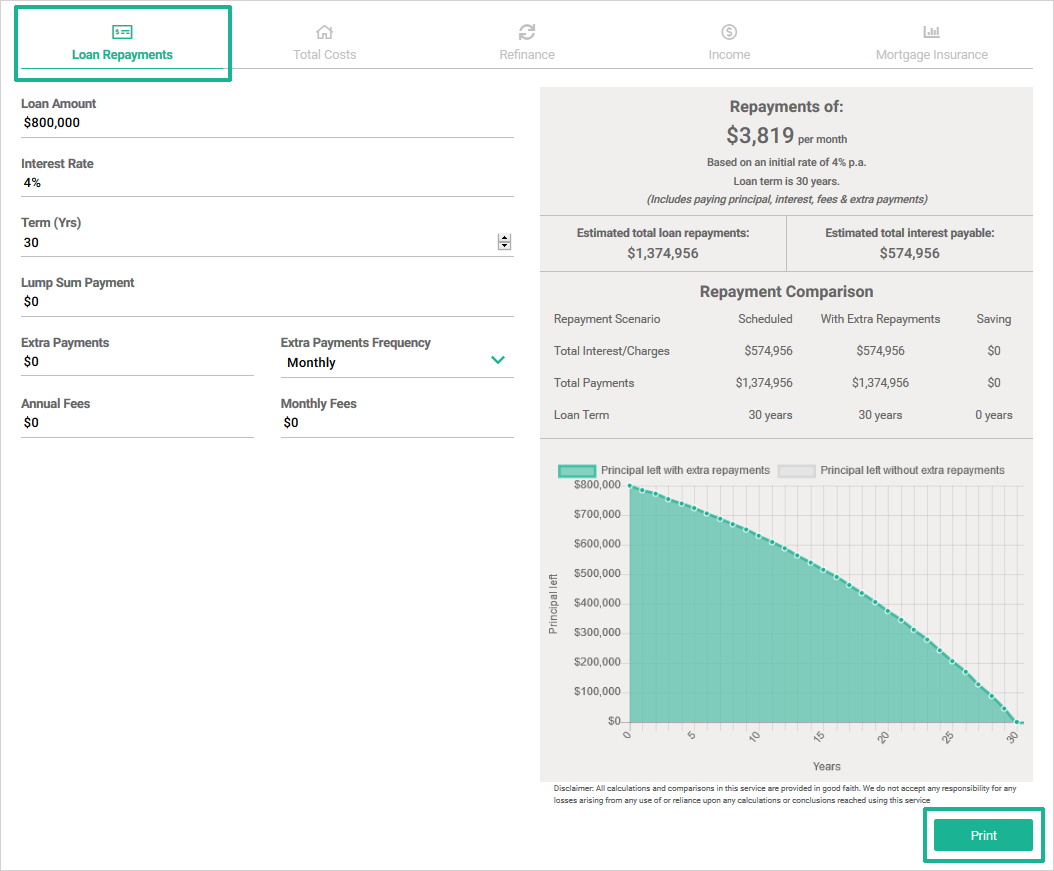

Loan Repayments Calculator

This dynamic calculator adjusts as you input key variables and information such as:

- Loan Repayments

- Interest Rate

- Term of Loan

- Lump Sum Payment and Extra Repayments and Extra Repayments Frequency

- Annual Fees and Monthly Fees.

Infinity’s calculator displays the required principal and interest repayments to clear the loan in full within the loan term. This calculator, you can print each graph by clicking the print button.

Interest Only Repayments

Interest only repayments are straightforward to calculate therefore no

repayment calculator is required.

Loan Repayment multiplied by the Interest Rate divided by 365 days in the year multiplied by the days in the

month, as an example:

Loan amount $500,000.00 | Interest only rate of 4.5% | Days in year 365 | January has 31 days =

$500,000.00 x 4.5% / 365 days in a year x 31 days in January = $1,910.96

Note: interest only rate varies depending on how many days there are in any particular month.

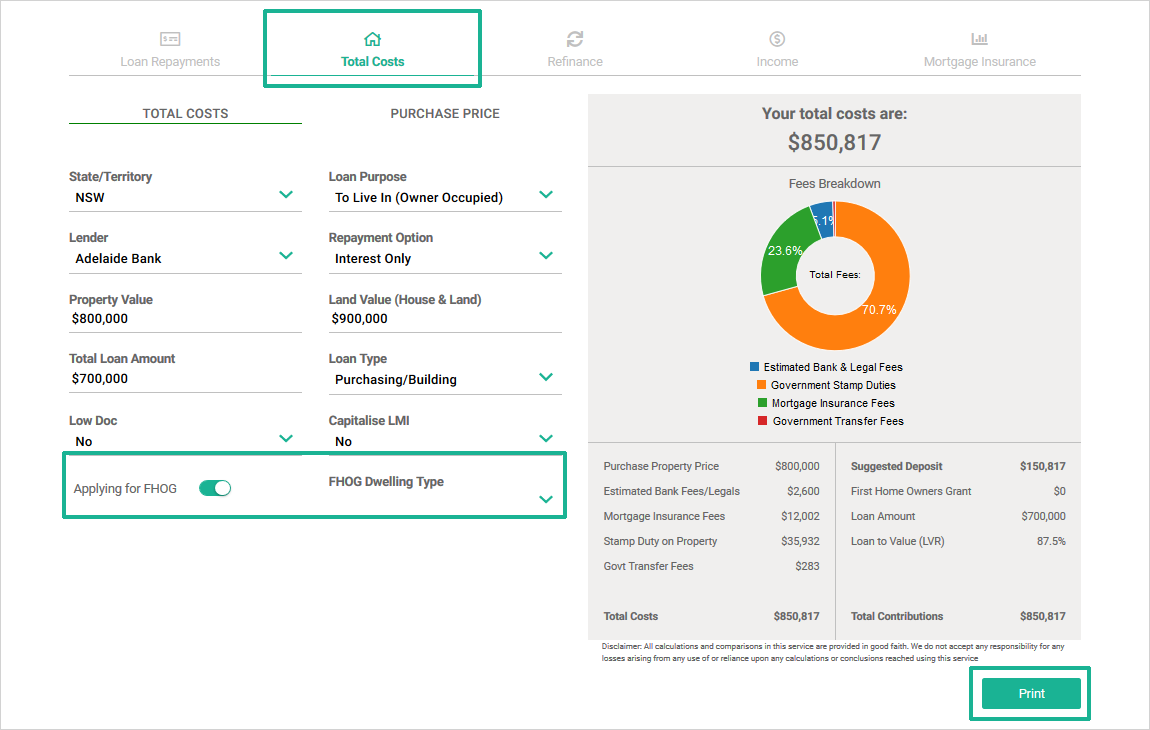

Total Cost

The Total Costs Calculator uses the following variables to create the costs graph:

- State / Territory: required so that accurate state specific fees and charges are applied

- Loan Purpose: Owner Occupied or Investment (to rent out)

- Lender

- Repayment Option: Principal and Interest or Interest Only

- Property Value

- Land Value

- Total Loan Amount

- Loan Type: Purchasing/Building or Refinancing or Purchasing/Refinancing

- Lo Doc: Yes or No

- Capitalise LMI: Yes or No.

Dynamic results are displayed on screen as you change variables and a report

can also be created by clicking the 'Print' button.

Toggle the options on Applying for FHOG and FHOG Dwelling

type (New Home or established Home) if applicable to the transaction as shown:

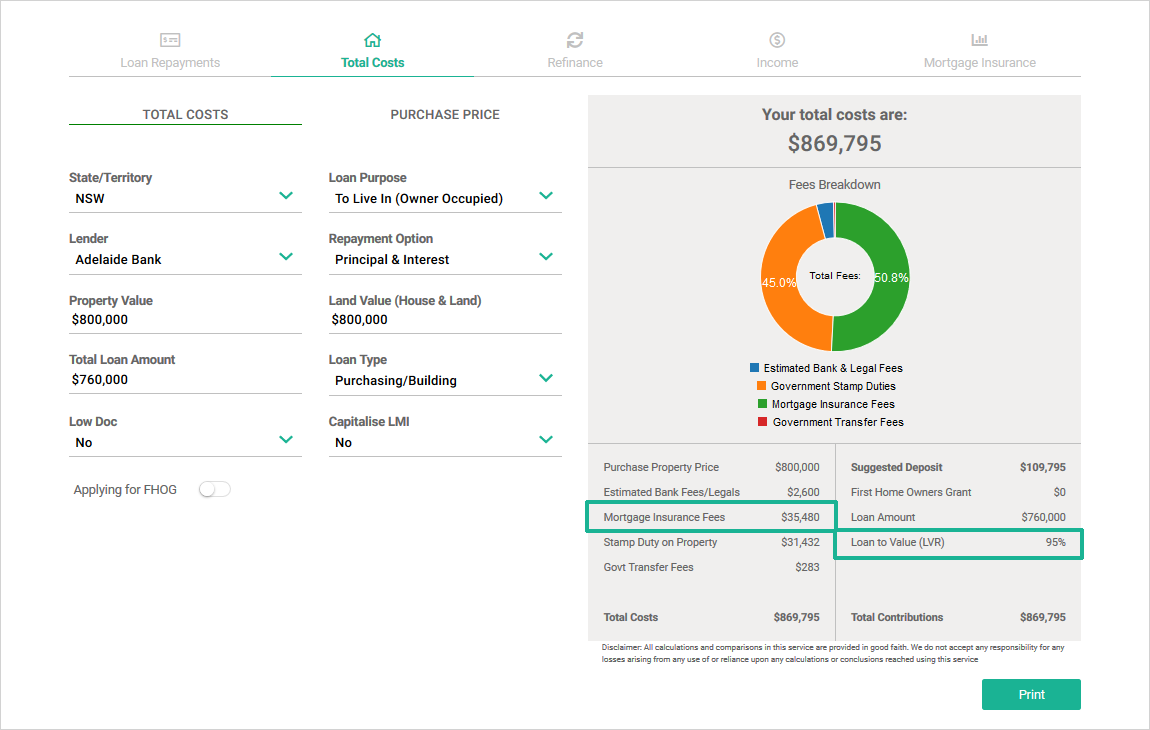

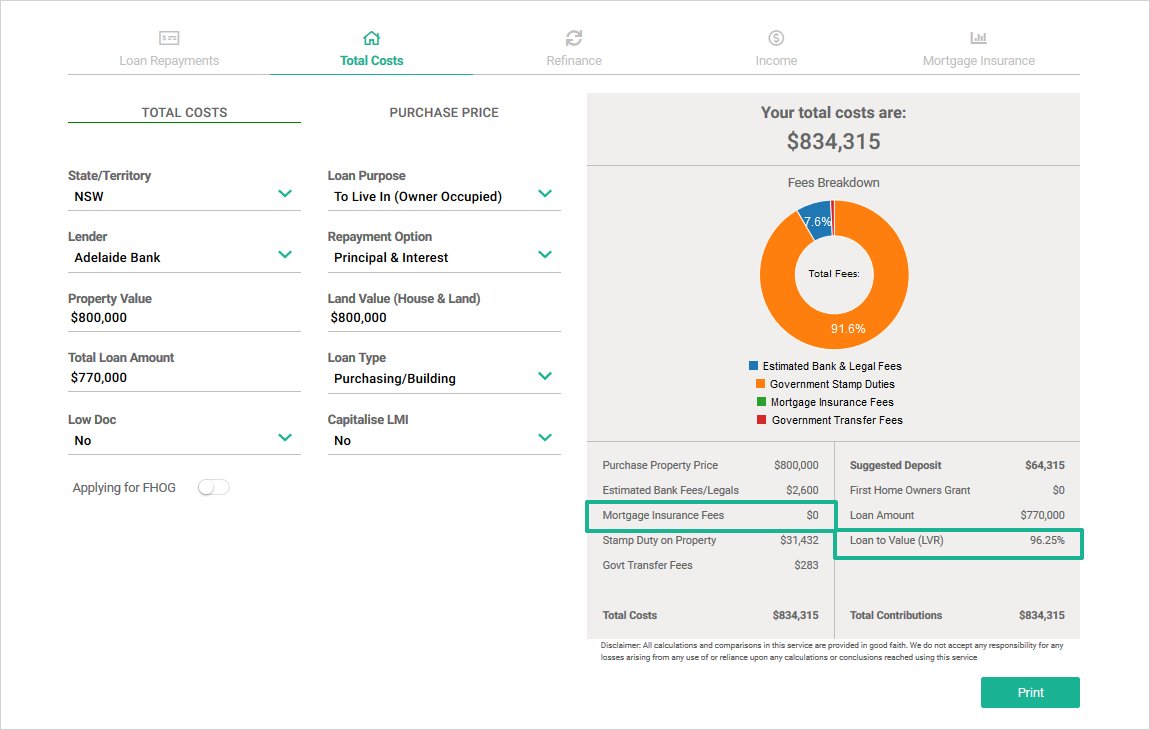

Note, if the base LVR is greater than 95.00%, then the

LMI calculation is not

possible.

Capitalising LMI will calculate a premium and final LVR, providing the base LVR is less

than

95.00% as shown below in the two examples:

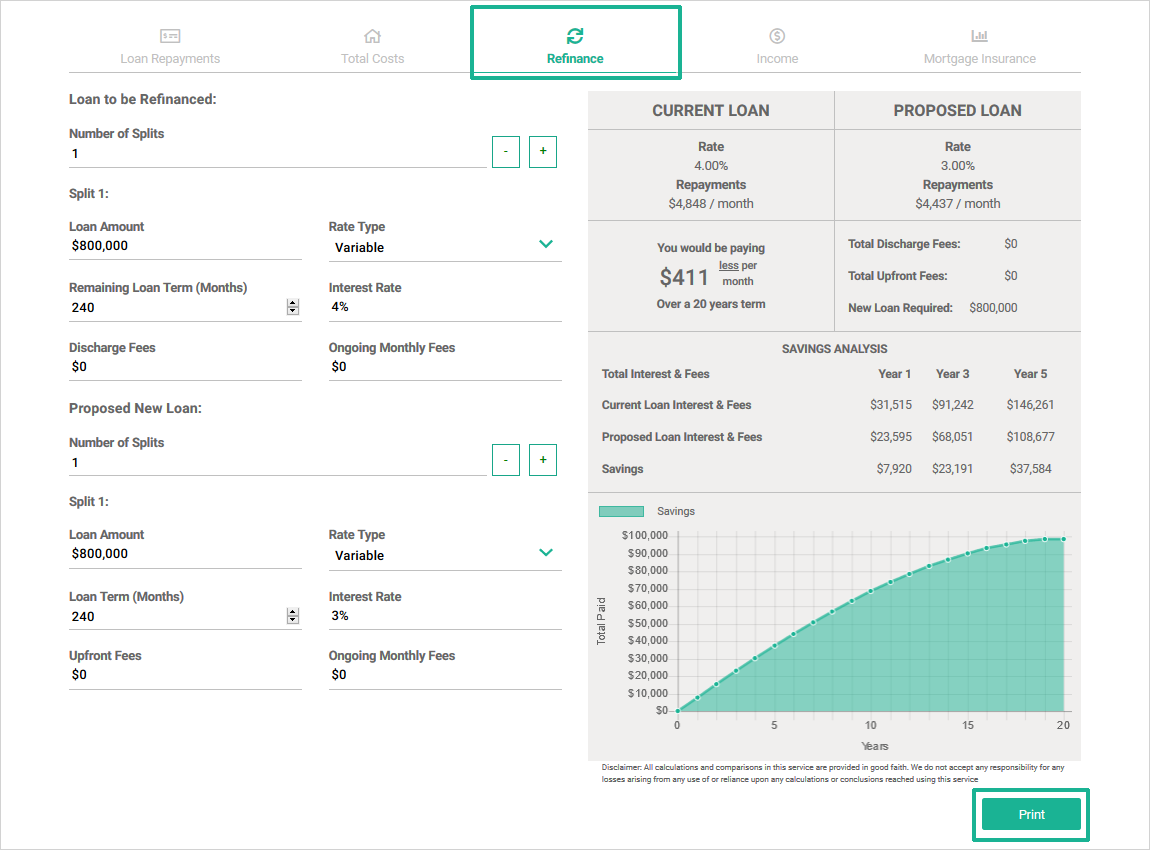

Refinance

ASIC requires that a Refinance Calculation is completed for every loan

application where existing lending is refinanced. The comparison must be done between the outgoing loan with

exit costs against the proposed new loan including all entry fees.

This calculator will show you how much interest you could save (if applicable) by refinancing the existing

loan to a new lender or the same lending but a different product / loan. The required information of the

existing loan is:

- Existing Lender current loan amount owing

- Current interest rate

- Remaining loan term in months

- Current monthly / annual fees

- Any and all Discharge fees or penalties including Economic Cost.

For the new loan facility to compare against:

- New loan amount (for true refinance interest rate savings show a calculation with the same loan amount as the existing loan)

- New loan term in months (for true refinance interest savings benefits show a calculation with the same loan term as the existing loan term) Note: increasing the loan term can be disadvantageous to the borrower

- New interest rate

- All Upfront / entry / establishment fees or charges including valuations (if applicable) and mortgage transfer fees

- Any monthly / annual fees.

The dynamic Refinance Calculator will show how much interest could be saved per month by switching to new loan. Annual savings are segmented to Year 1, Year 3, and Year 5 as well as the graph display. This report can also be saved as PDF or printed out by clicking in the 'Print' button.

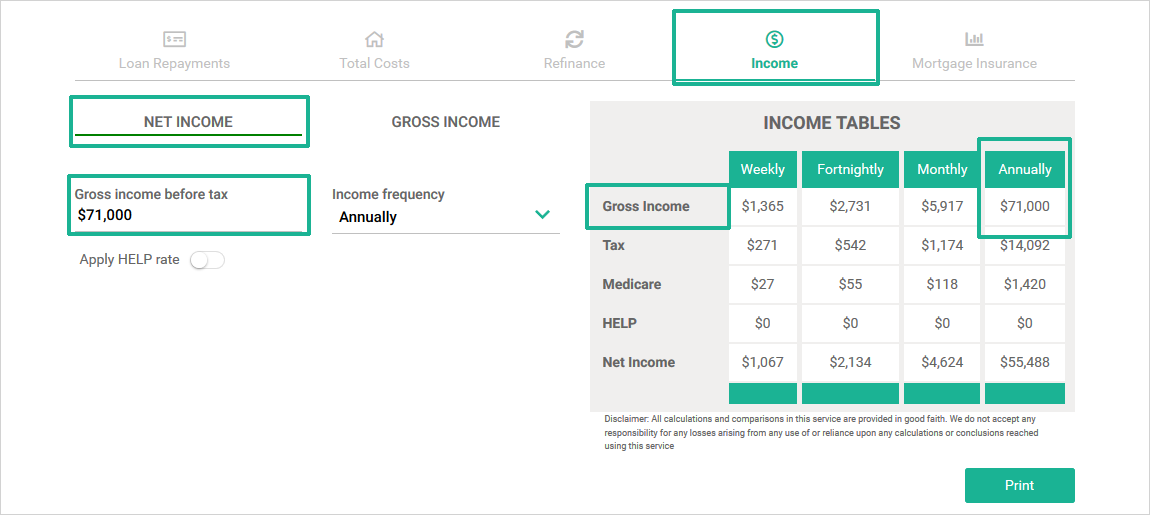

Income

The page displays a simple Income Calculator using the current ATO (Australian

Tax Office) tax rates.

The Net Income calculator requires you to input:

- Gross income amount before tax calculated

- Income frequency: Monthly or Annually or Year To Date

- Apply HELP rate: previously known as HECS (student loan)

- 'Print' option available or save as PDF.

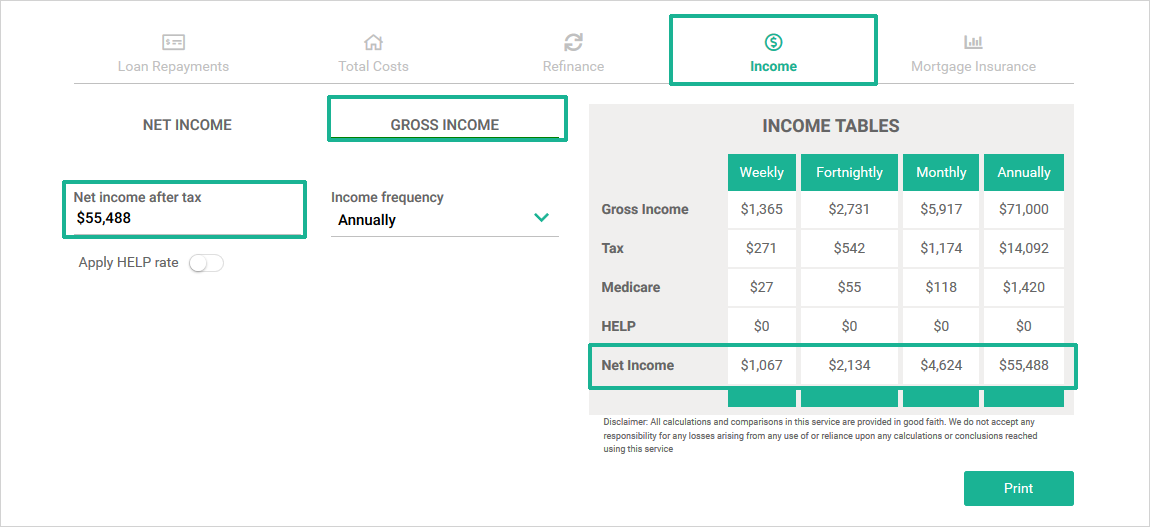

Alternatively, the Gross Income Calculator requires you to input:

- Net income amount after tax

- Income frequency: Monthly or Annually or Year To Date

- Apply HELP rate: previously known as HECS (student loan)

- 'Print' option available or save as PDF.

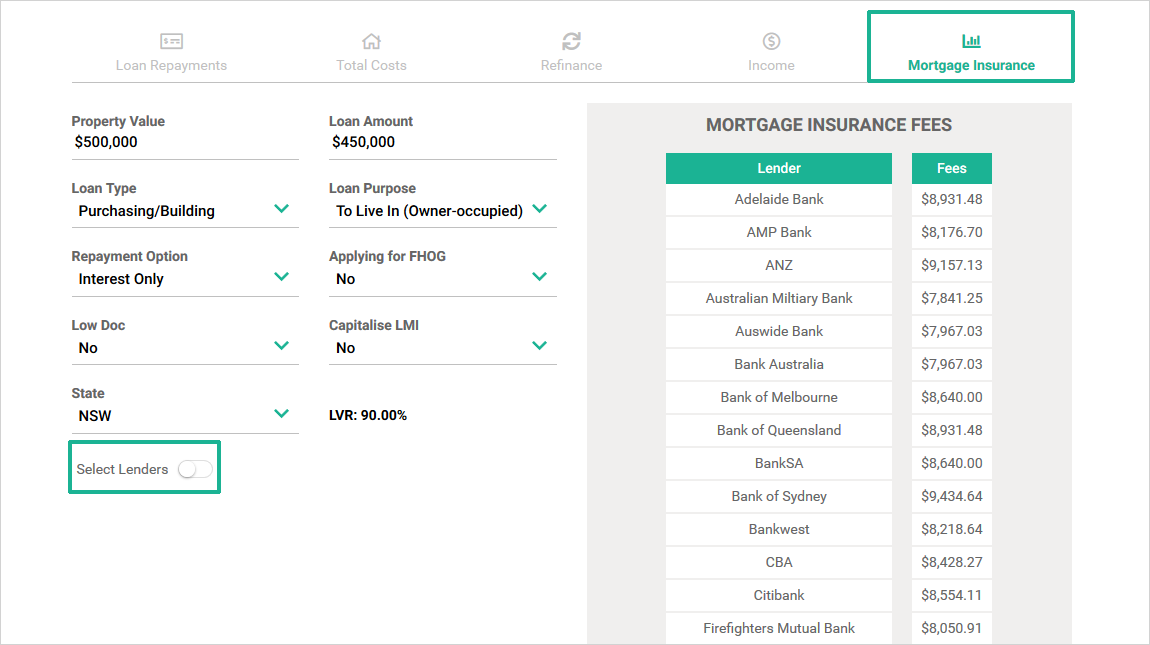

Mortgage Insurance

Lenders Mortgage Insurance (LMI) can apply if the Clients loan to security

value ration is higher than 80%. The amount can be significant depending on the loan size and how high the

LVR is.

The Mortgage Insurance Calculator requires the following information to calculate the LMI premium:

- Property Value

- Loan Amount

- Loan Type: Purchasing/Building or Refinancing

- Loan Purpose: Owner Occupied or Investment

- Repayment Option: Principal and Interest or Interest Only

- Applying for FHOG: Yes or No

- Low Doc: Yes or No

- Capitalise LMI: Yes or No

- State: customise

- LVR: will be displayed based on property value and loan amount.

Mortgage Insurance Fees / Premiums are displayed alphabetically by Lender. You can reduce the number of Lenders displayed by toggling the 'Select Lenders' button and individually selecting only certain lenders as shown: