Honey Insurance

Honey Insurance – Launch of Broker Training Overview of Offering

Honey Insurance – Practical Training Covering Four Key Components

- Navigate

-

Click on the content list below

to skip ahead to the different sections

on this page -

Client Centre Tab

-

Client Centre

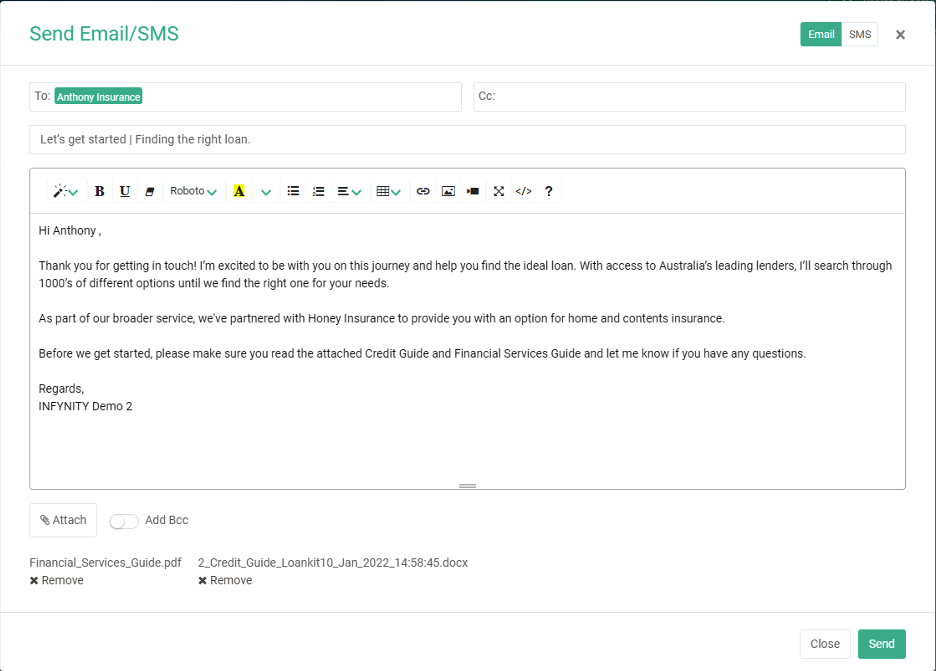

Sending the Financial Services Guide & Credit Guide - How to

For customer loan applications relating to property purchases, a valid building insurance policy will be required by each Lender. To remain compliant, the Broker must issue each customer a Financial Services Guide (FSG) at the same time that the Credit Guide (CG) is issued. The steps to follow to issue the FSG & CG are:

- Accounts tab | Manage Accounts tab | Client Details [including saving the customer's email address & phone number]

- From within the customers profile, access the side menu bar “Account Options”:

- Select the 'Send Credit Guide' option

- Automatically attached will be your Credit Guide & Financial Services Guide

- Press the 'Send' button

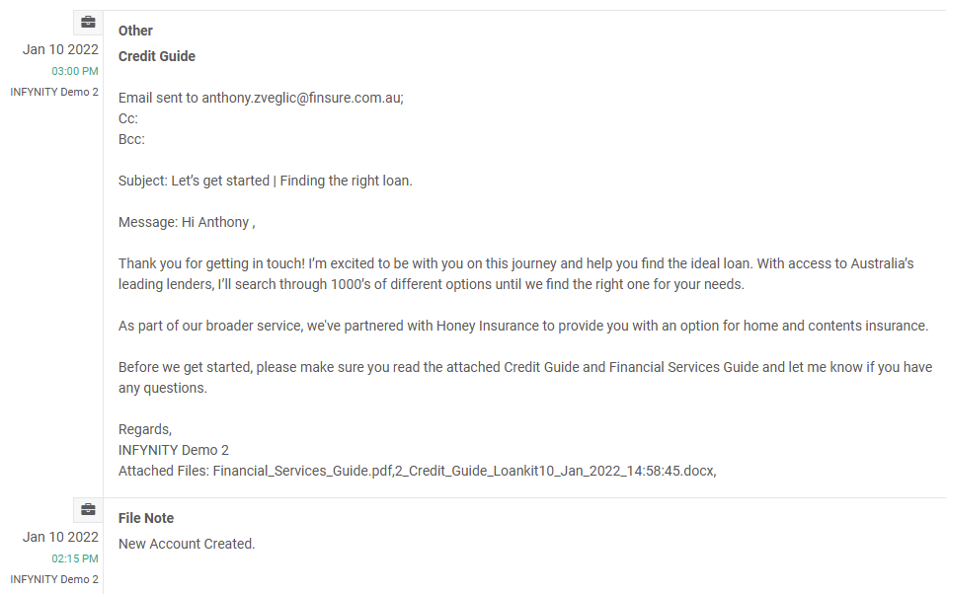

A customer File Note will be automatically created within your customer profile at this stage as shown below:

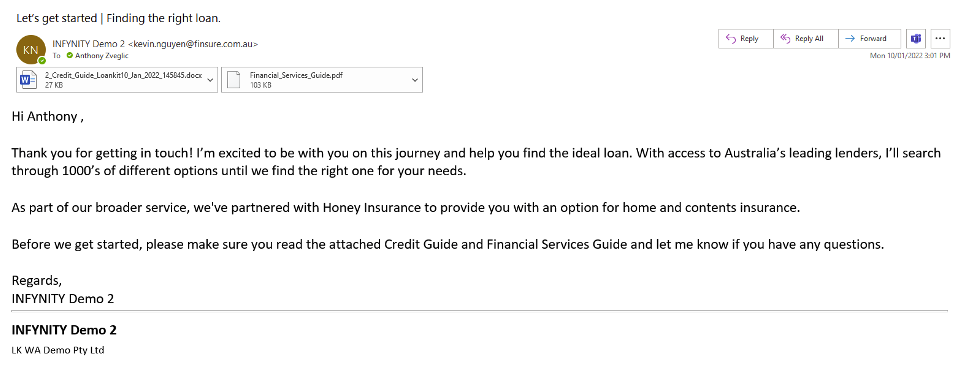

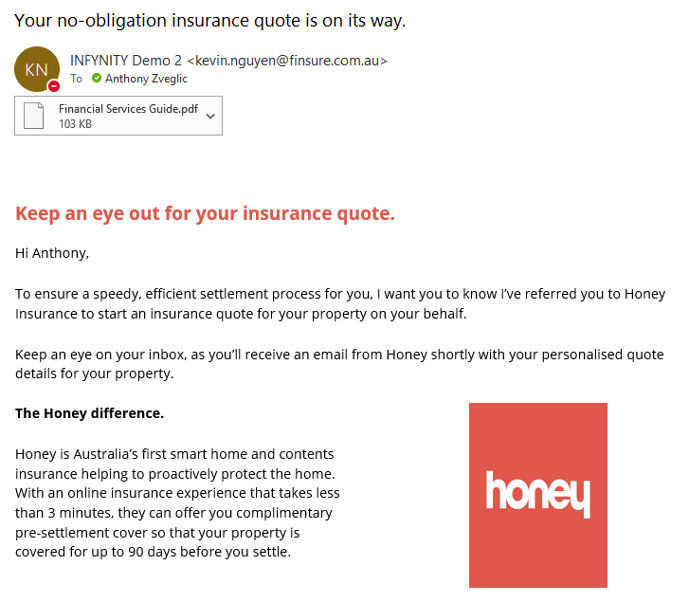

This is the email communication that your customer will receive:

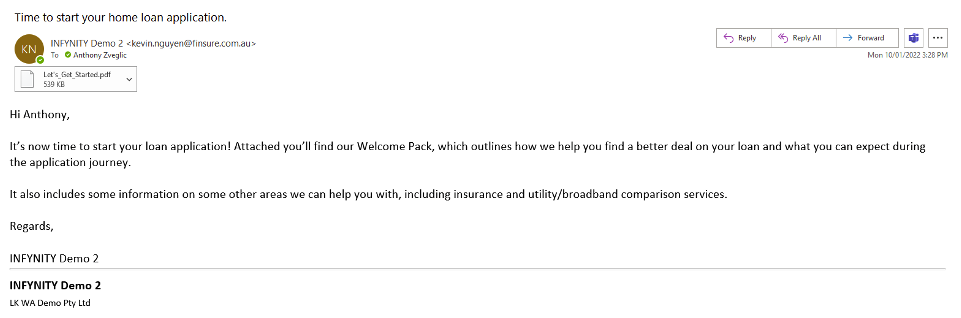

Sending Automated Emails from Templates - How to

For all customers, the following Email Templates are available for you to use:

- Loan Process [with Honey]. This email to your customer includes a 6-page attachment called “Let's Get Started” which covers the following information:

- Talk to someone who gets it [the Broker]

- So what comes next

- Beyond home loans, Stay protected

- What makes Honey Insurance smarter

- Honey Referral - Unconditional Process. This email to your customer includes the Financial Services Guide plus information on Honey Insurance and how to complete the quote as a customer:

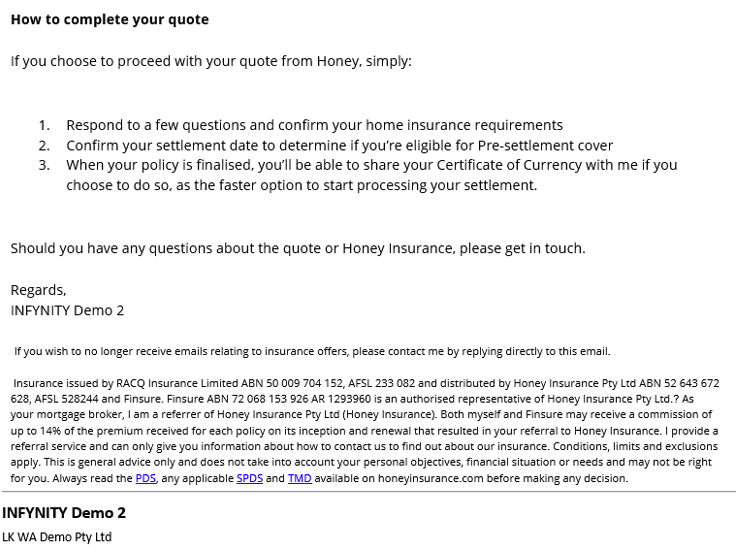

Honey Insurance - Statement of Credit Assistance (SOCA)

For all customers, when you complete their Statement of Credit Assistance, on the Commissions/Conflict of Interest tab Honey Insurance will pre-populate with Upfront Commissions noted under other Recommended Products. If you remove this entry, the automation that is built into the Infynity platform will not trigger any of the next steps that Honey Insurance undertakes. When your customers loan application reaches 'Unconditionally Approved' status, the following morning at 10am the customer journey automation will commence with the following events:

- Customer receives email from Honey Insurance with online link to complete required details

- information we haven't yet collected on the property during the conversations

- customer consent

- Broker receives email with the same information as a courtesy

- There is an option for customer to call Honey Insurance instead of completing the information online

- When the customer goes to the link the process takes approximately 3 minutes to complete the quote

- Certificate Of Currency [Insurance] can be provided at this stage

- Customer must acknowledge at this stage that the Broker can also receive a copy of the Certificate of Currency

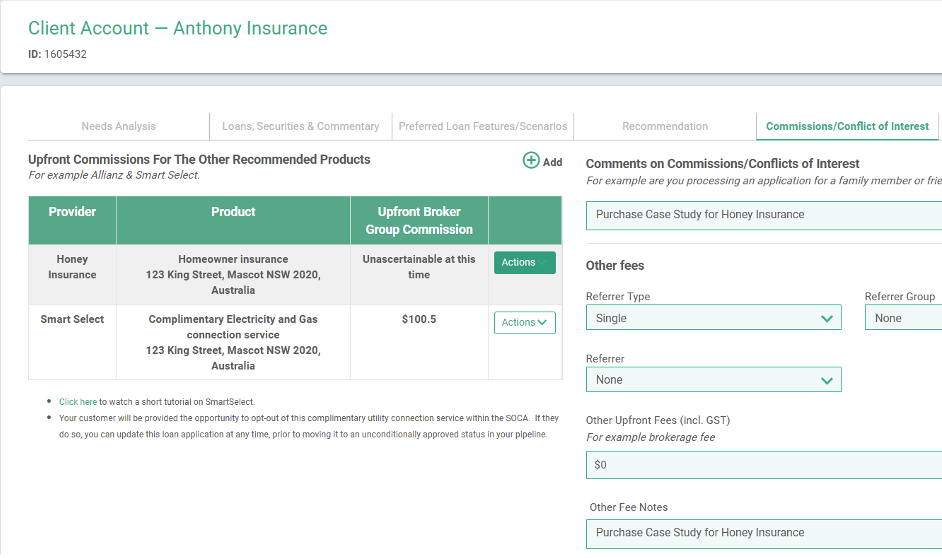

Honey Insurance - Loans & Products | Third Party Referrals - How to

This option is available for any customers in your Infynity database that do not currently have a home loan application in process.

From within the customers profile, access the side menu bar “Account Options”; scroll down through the options to 'Create Referral' as shown below:

When you select the ‘Create Referral’ button you are required to complete the following information:

- Referral Type = General Insurance

- Select Applicant/s

- Insurance Type = Home & Contents or Landlord

- Comments = include any relevant information such as property details for insurance coverage

- Confirm the two acknowledgement declarations as shown below:

The customer journey automation will commence with the following events:

- Customer receives email from Honey Insurance with online link to complete required details:

- information we haven’t yet collected on the property during the conversations

- customer consent

- Broker receives email with the same information as a courtesy

- There is an option for customer to call Honey Insurance instead of completing the information online

- When the customer goes to the link the process takes approximately 3 minutes to complete the quote

- Certificate Of Currency [Insurance] can be provided at this stage

- Customer must acknowledge at this stage that the Broker can also receive a copy of the Certificate of Currency