BID Help Guides

- Navigate

-

Click on the content list below

to skip ahead to the different sections

on this page -

Loans and Products

-

Needs Analysis Tab

-

Loan Objectives

-

Loan Requirements

-

Loans, Securities & Commentary Tab

-

Preferred Loan Features & Scenarios Tab

-

Loan Features

-

Loan Scenario Comparison

-

Recommendations Tab

-

SureScore

-

Commissions/Conflicts of Interest Tab

-

Client Forms Tab

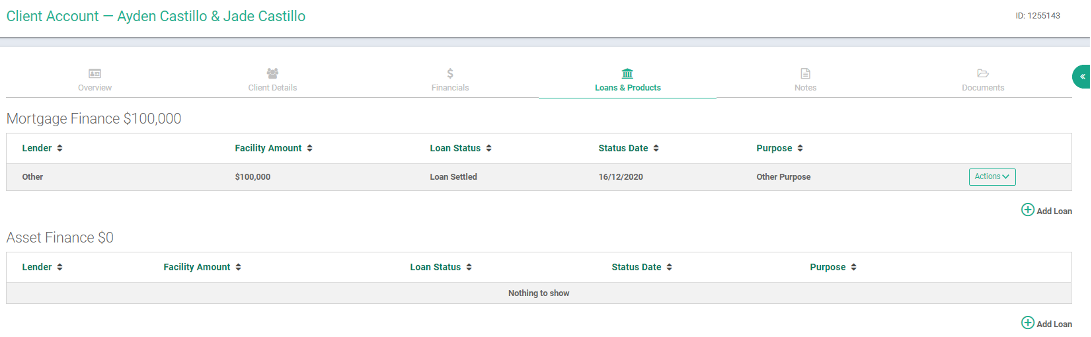

Loans and Products

All right, now it is time for you to update your client's loan status. You can update mortgage products and client's asset status from this section. Click the 'Loans & Products' tab and click the 'Add Loan' button.

In this section you can Add or Edit the finance application that the client is applying for (the new lending facility or edit the existing facility you have entered). Currently there are options for:

- Mortgage Finance

- Asset Finance (including Personal Loans)

If no existing lending facilities exist, when you click on the Loans & Products Tab - a new separate page will open with the following areas for you to complete:

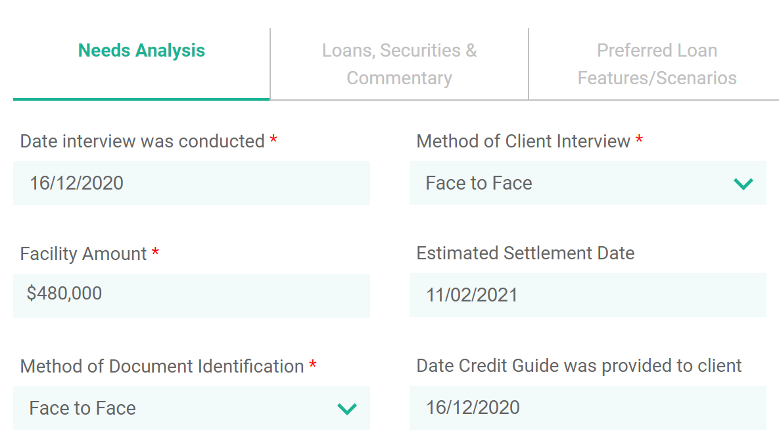

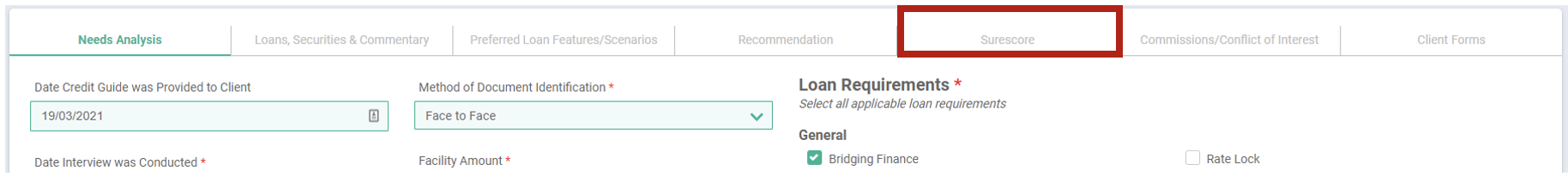

Needs Analysis Tab:

- Date interview was conducted

- Method of Client Interview:

- Face to Face

- Video

- Telephone

- Facility Amount

- Estimated Settlement Date

- Method of Document Identification:

- Face to Face

- Certified/Prescribed Persons

- Branch

- VOI

- Date Credit Guide was provided to client

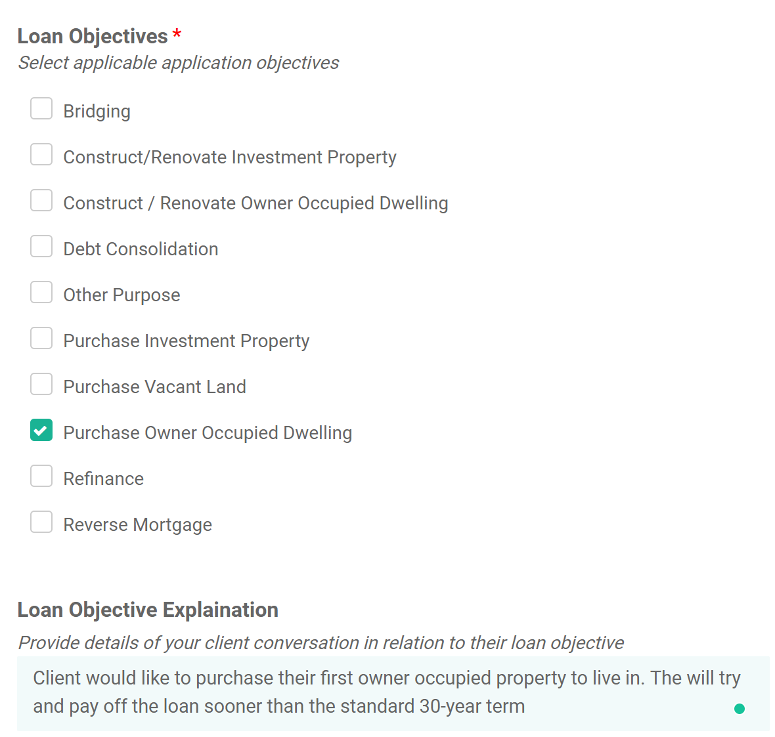

Loan Objectives

- Loan Objectives, select as many objectives as applicable

- Loan Objectives Explanation, provide verbatim comments in relation to the client Loan Objectives (ie, I would like a home loan where I can pay it off sooner and have the option to make additional lump payments when I get my quarterly bonuses which are approximately $15k per quarter)

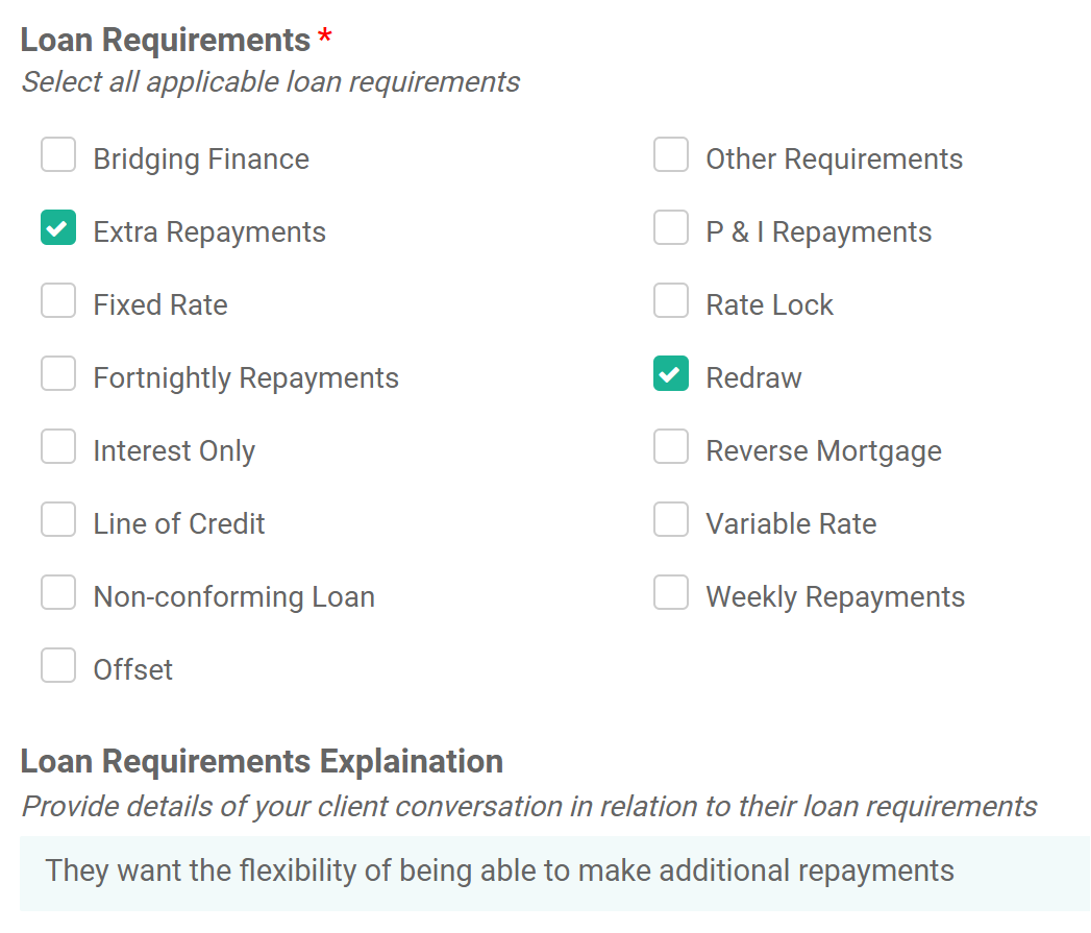

Loan Requirements

- Loan Requirements, select all applicable requirements (also known loan features)

- Loan Requirements Explanation, provide verbatim comments in relation to the client Loan Requirements (note: generally if more items are selected, the client may have less Lender/ Products to select from – not all Lenders have offset feature)

- Is this a refinance application – toggle green if yes and answer the subsequent four questions

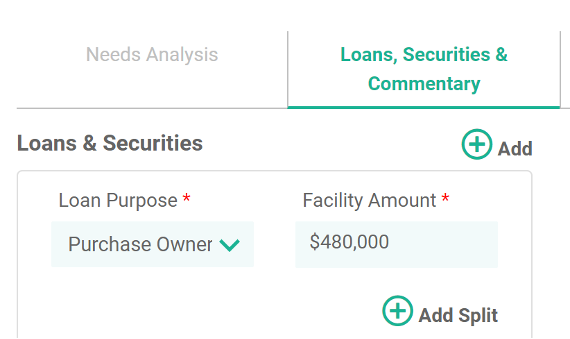

Loans, Securities & Commentary Tab:

- Loan Purpose is carried forward from the previous page Loan Objectives (Needs Analysis tab). There can be more than one objective (ie Purchase Owner Occupied Dwelling + Debt Consolidation)

- Facility Amount, enter the loan amount required

- Add split if required (ie Variable + Fixed facilities)

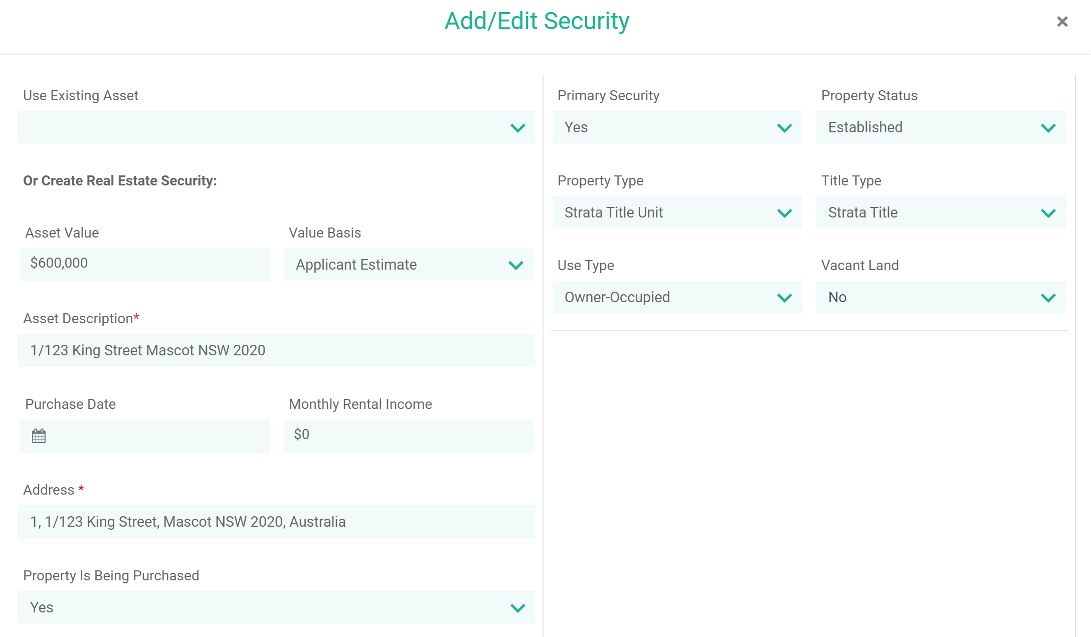

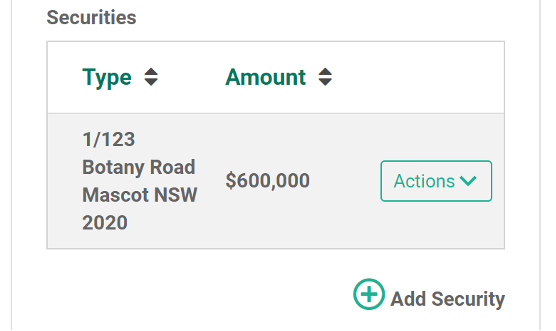

- Securities, Add Security for the loan as shown:

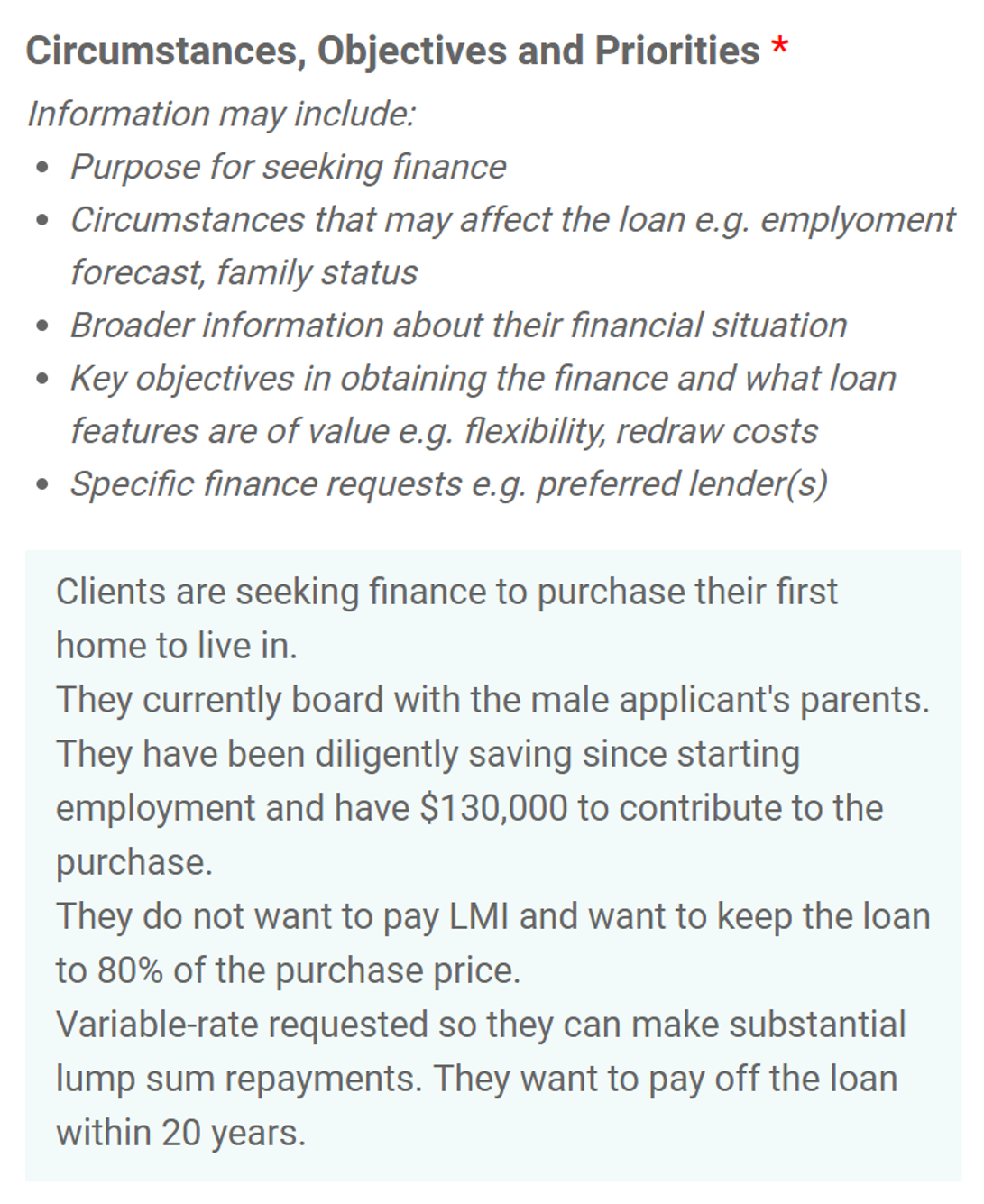

- Circumstances, Objectives and Priorities must be recorded, provide verbatim comments in relation to the clients:

- Circumstances - how did the client arrive to this financial position (ie previous finance they have obtained for example credit cards, personal loans; contribution to the purchase – is it through savings, inheritance, equity in another property or other)

- Objectives - what do they need the Lender / Product to do. What is the financial goal (ie, own my own home in 20 years with no debt)

- Priorities – what is the most important aspect of the finance application (ie, preferred lenders, lenders they do not wish to be considered, lenders with branch access, lenders with card-less cash)

-

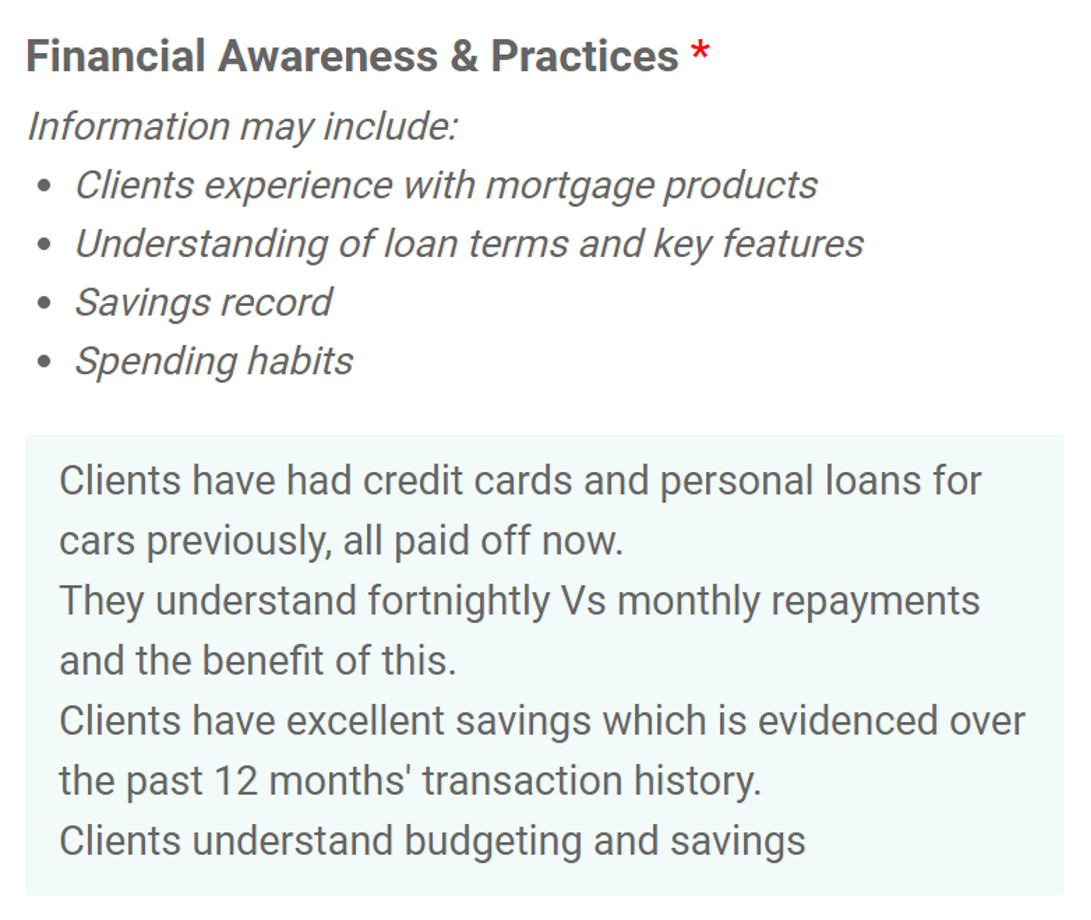

Financial Awareness & Practices must be recorded, provide verbatim comments in relation to the clients:

- Financial Awareness – has the client had any financial products previously and what was the conduct (ie, credit cards, personal loans, after pay, payday loans, mortgage – if previous mortgage product detail their understanding of loan terms and key features)

- Financial Practices – has the client previously completed a budget, are they financially savvy (ie, what are their spending and saving habits)

-

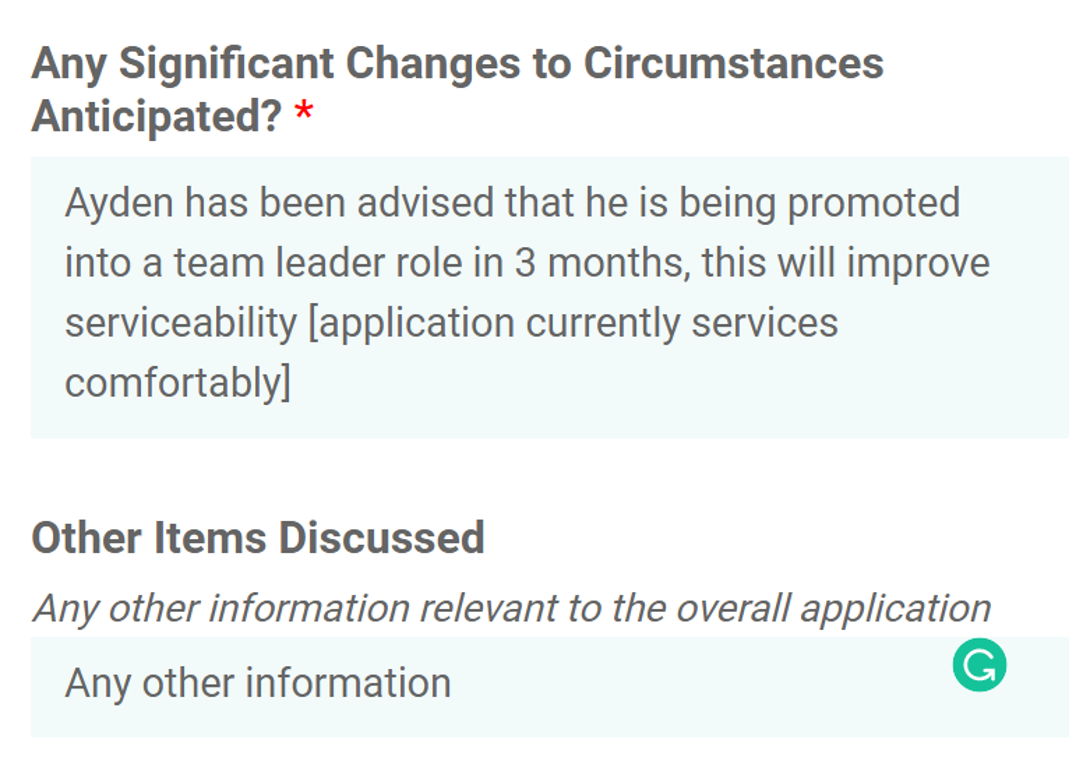

Any Significant Changes to Circumstances Anticipated

- Change to known future income (ie, probation period ending with 20% increase to PAYG salary; extended unpaid leave for round Australia road trip holiday)

- Change to future expenses (ie, purchase of an expensive pet that requires significant financial investment upfront and for ongoing maintenance/support)

- Other Items Discussed

- Any other facts not already disclosed in the commentary

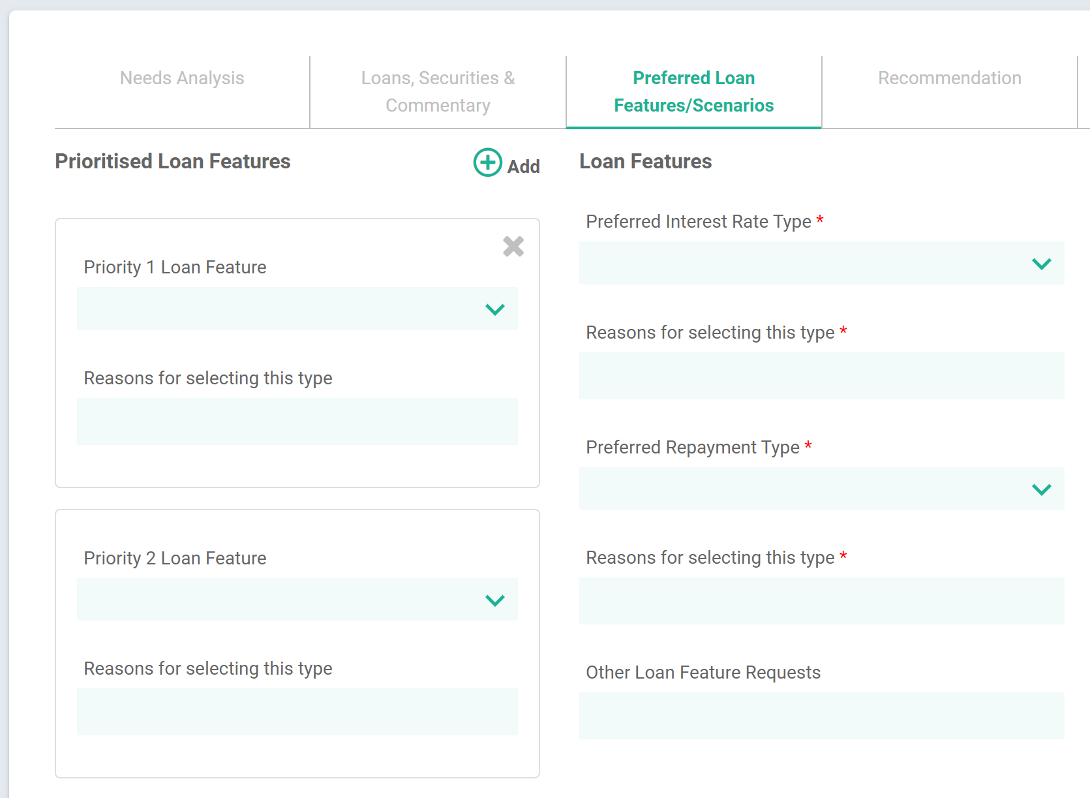

Preferred Loan Features & Scenarios Tab:

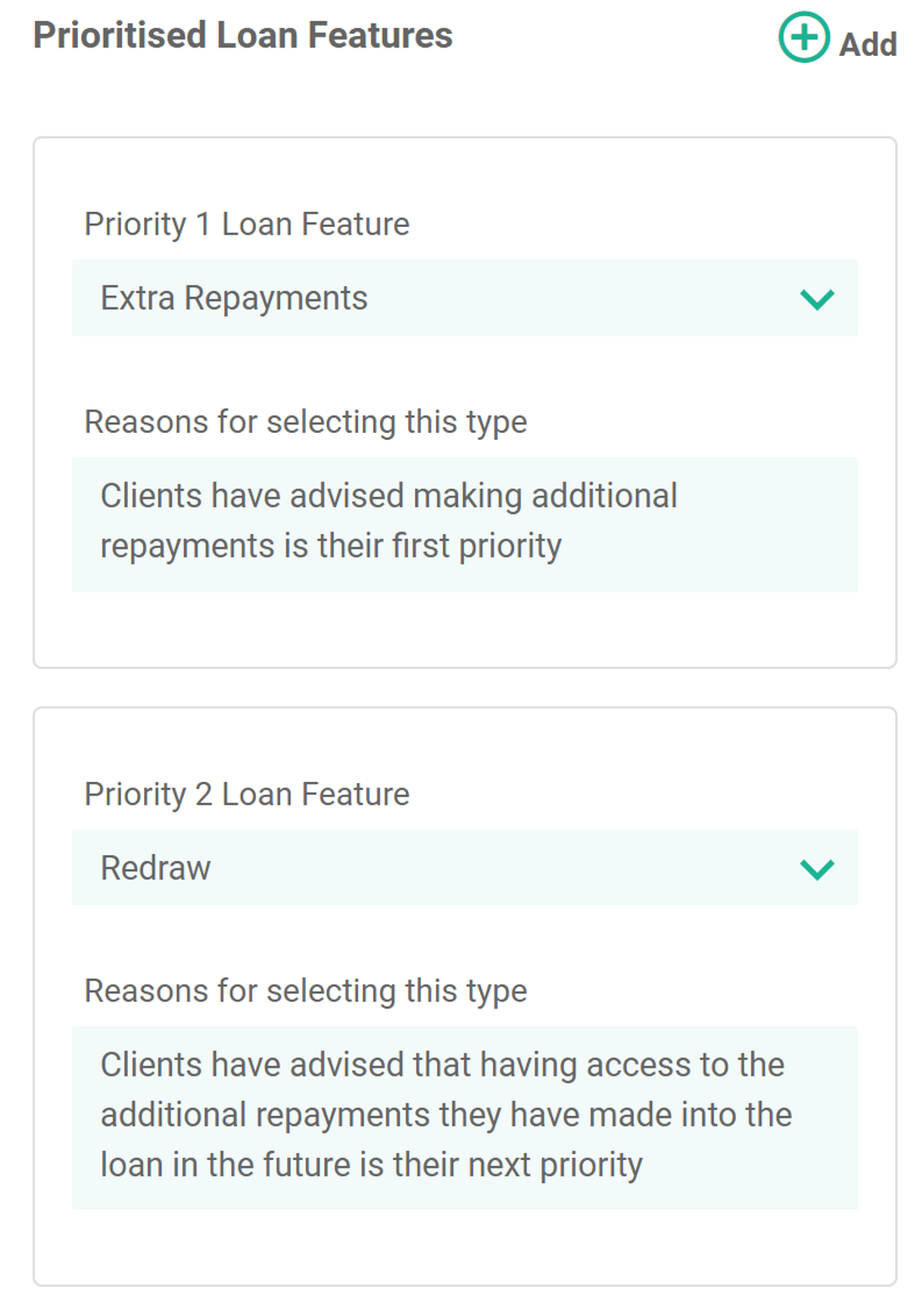

- Prioritised Loan Features

- Is carried forward from the previous page Loan Requirements (Needs Analysis tab). There can be more than one requirement (ie Extra Repayments and Redraw in this example) and they must be ranked in order of priority:

- You are required to detail reasons based on client conversations for selecting this feature and the priority it has been given. Refer to the example below:

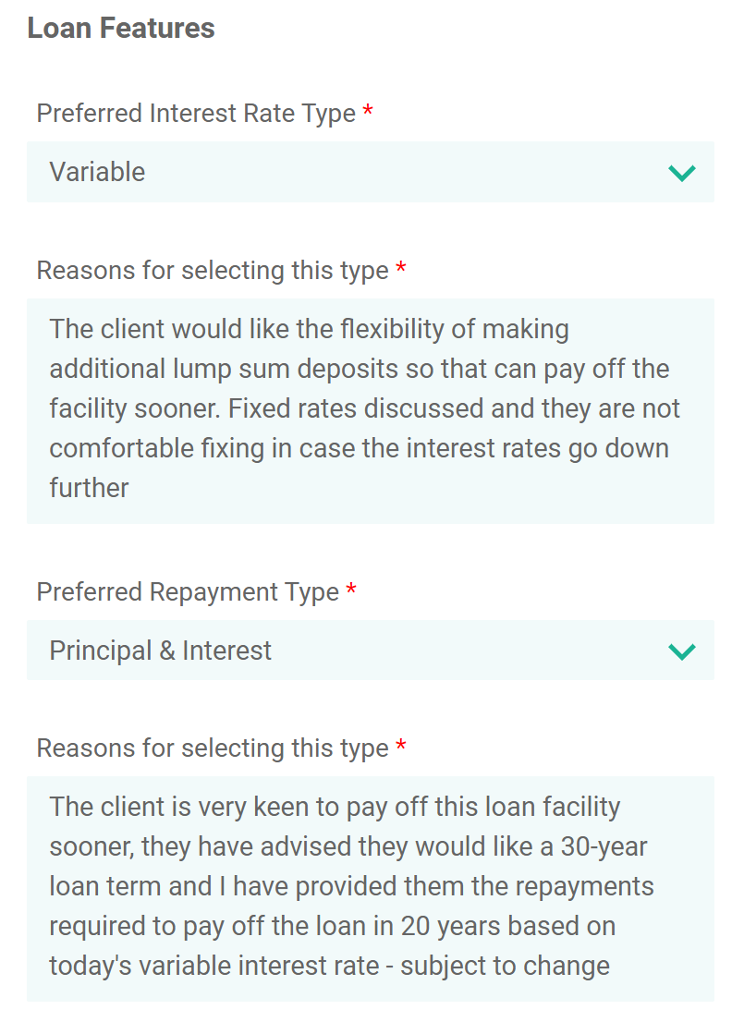

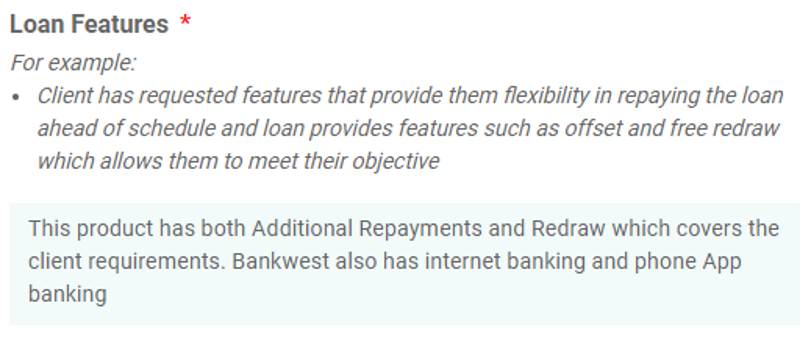

Loan Features

- Preferred Interest Rate Type, select from:

- Fixed

- Variable

- Fixed & Variable

- Line of Credit

- Reasons for selecting this Rate Type - you are required to detail reasons based on client conversations for selecting this rate type. Refer to the example below:

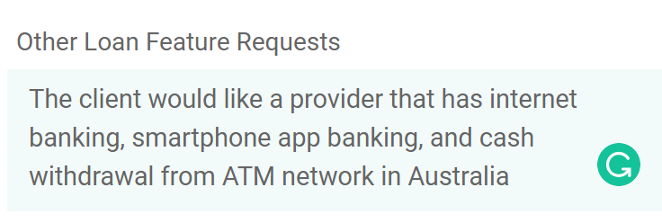

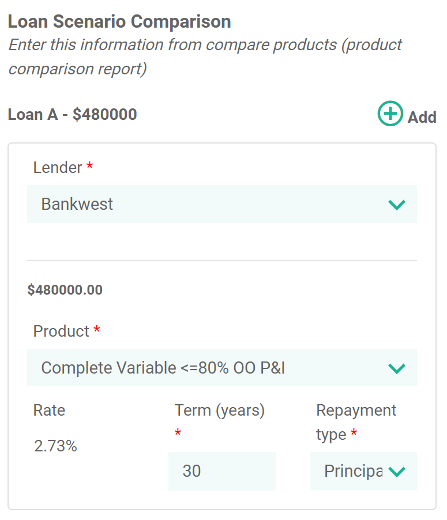

Loan Scenario Comparison

- After you have had the detailed customer conversation you are ready to complete the product comparison and recommend suitable Lenders and Loans from the selection available to you

- Enter this information from the Compare Products analysis you have completed

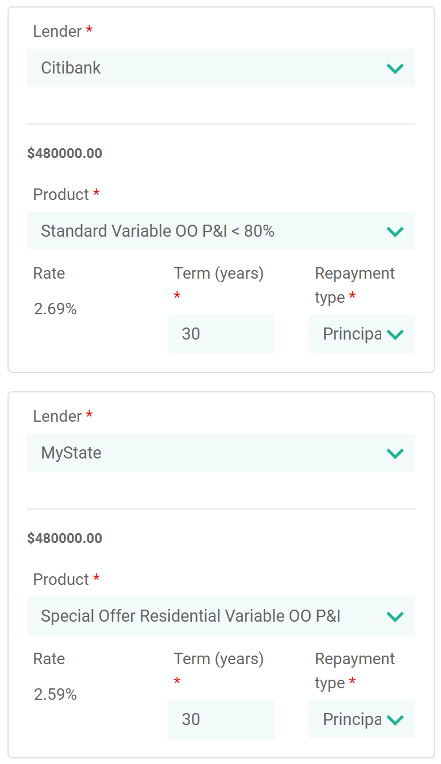

- You should enter at least three options or more if there are options available – there needs to be a Comparison. See the example below:

Recommendations Tab:

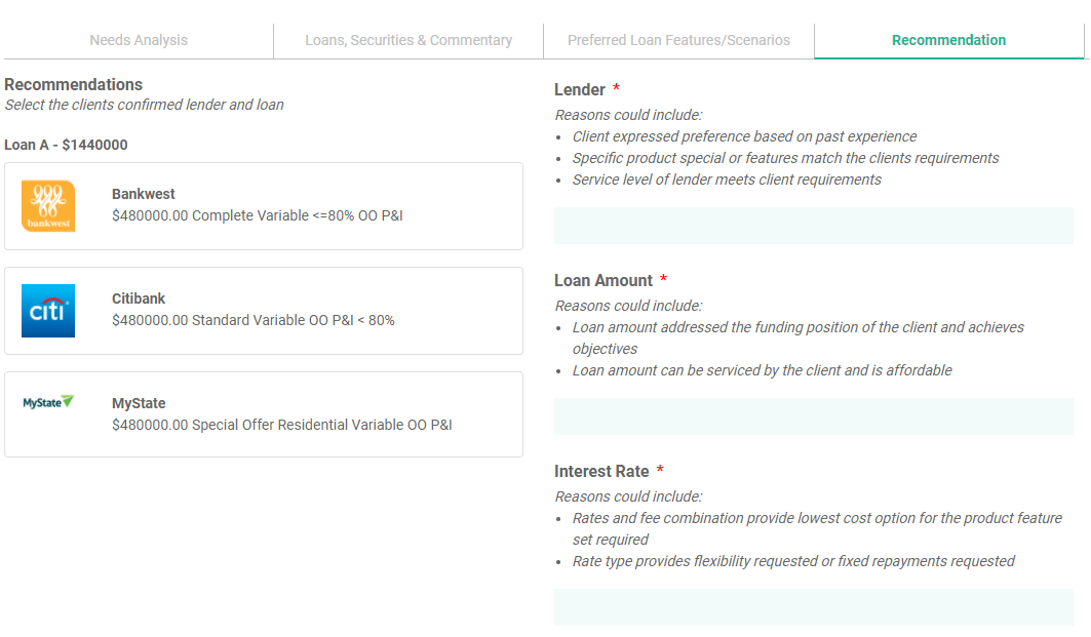

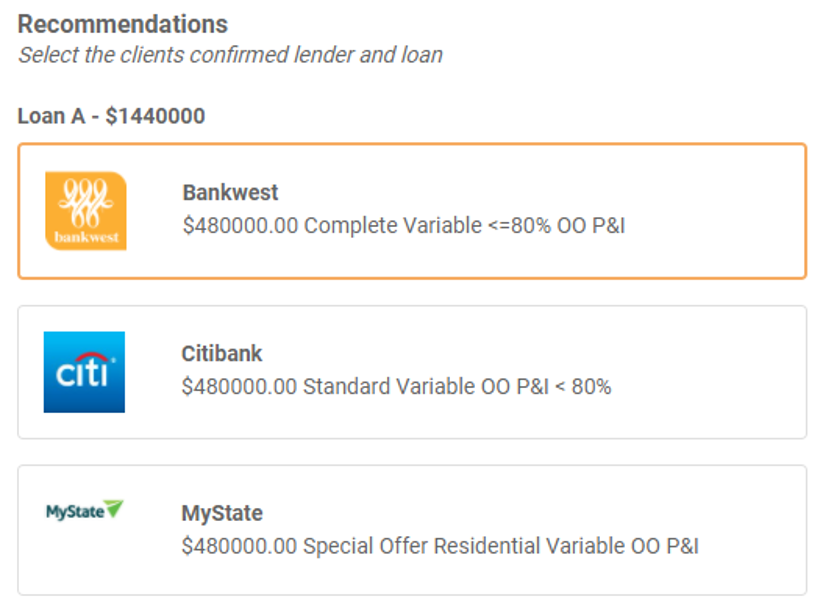

Now that you have had your client discussions and analysis of potential options, you are ready to confirm the client’s selection of lender and product:

Highlight the lender and product by clicking on the selection; the example below shows that we have selected Bankwest on this occasion:

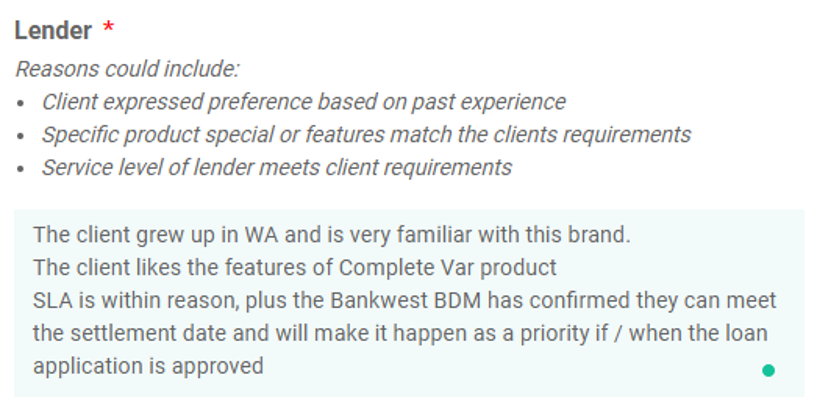

Now that the lender and product have been selected, you must make comments on the reasons why this specific lender and product was chosen in the following categories:

- Lender (ie based on client preference & brand knowledge)

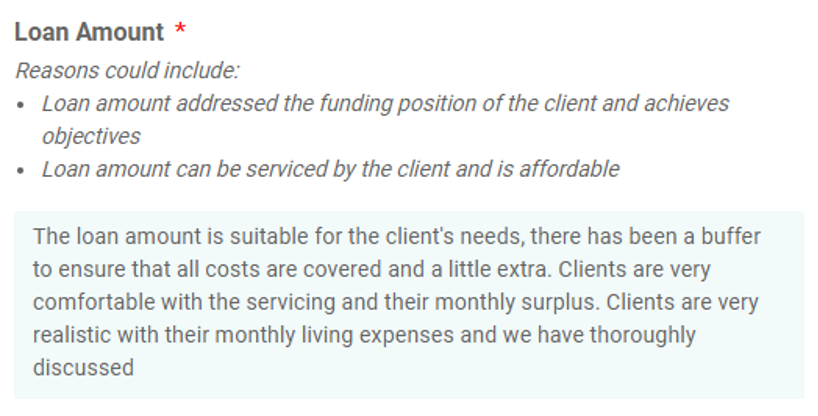

- Loan Amount (is the funding sufficient to complete the transaction)

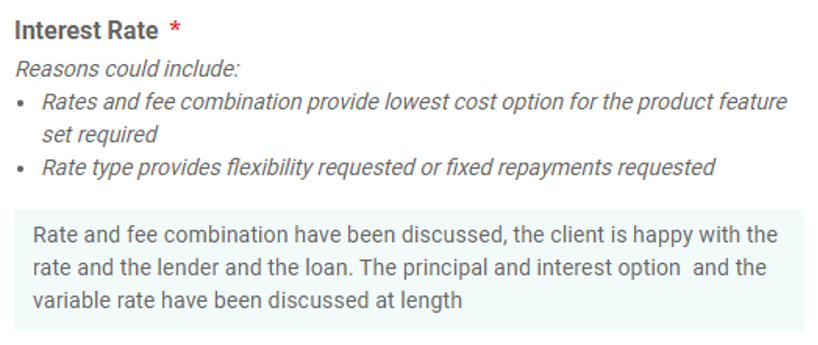

- Interest Rate (ie is the rate reasonable for the clients needs for specific features)

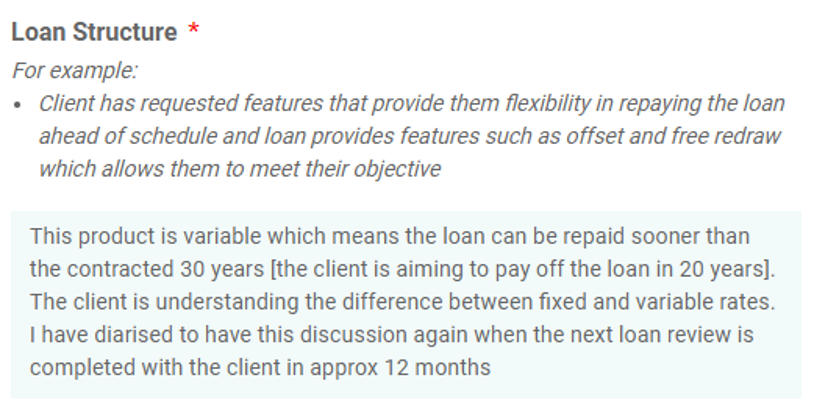

- Loan Structure (is the loan structured to accommodate the clients financial needs)

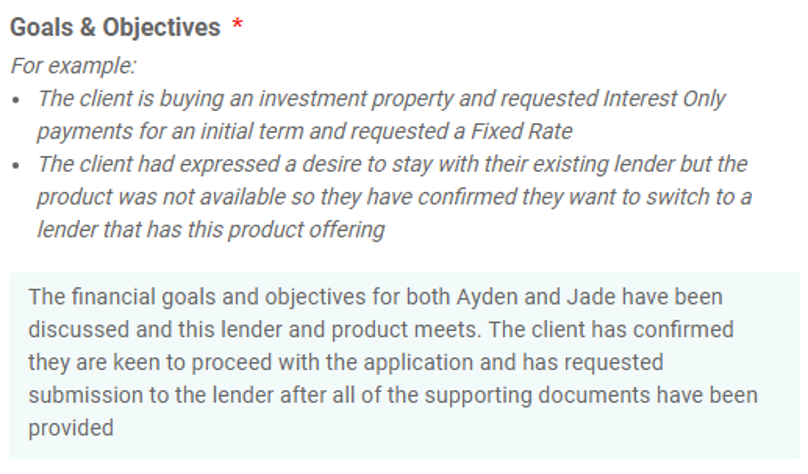

- Goals & Objectives (confirm that the clients financial goals and objectives have been met)

- Loan Features (have these been met based on the Preferred Loan Features/Scenarios Tab)

Refer to the examples below for further guidance, note your responses to every clients SOCA will need to be specific to the clients individual needs and requirements. It would be unlikely that all of your SOCAs for all of your clients would be the same

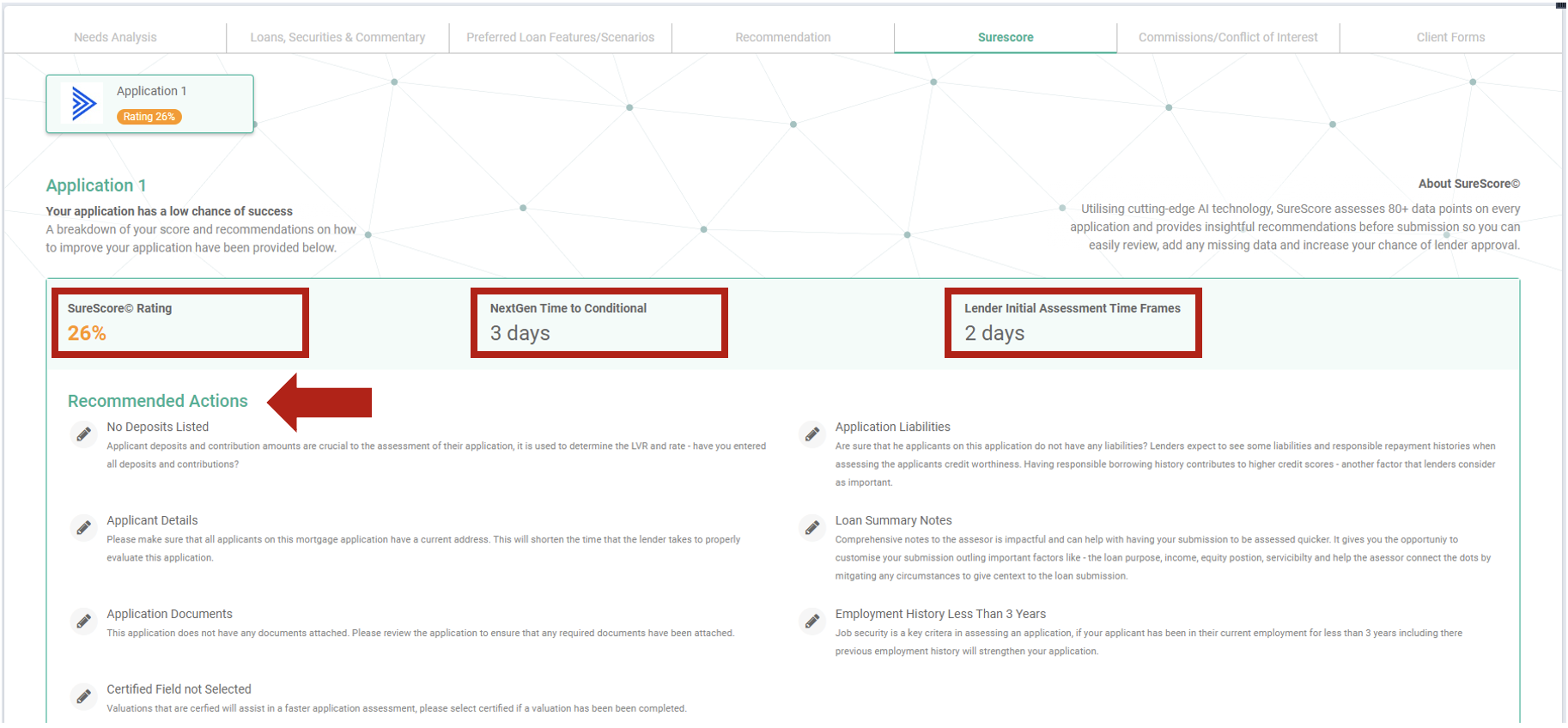

SureScore

SureScore is designed to assist brokers to improve the quality of submissions and gauge the likelihood of its success through to approval of lending application.

It provides a success rating based on the information that you have entered into the SOCA [statement of credit assistance] document and makes recommendations on some actions that could help improve the quality of the loan submission.

SureScore assesses 80+ data points on every application to help you review and add any missing data to increase your chances of a successful lender approval.

You can locate SureScore within your SOCA document as shown:

Actions to take

Following the recommendations and updating data where required will help improve the application and the SureScore rating and make the application ready for submission to your recommended lender that the customer has selected.

The Recommended Actions help highlight a field that may have been missed or a section that hasn’t been completed correctly.

As you update the Recommended Actions, the SureScore rating will increase providing an updated change of success based on the changes made.

Other useful information on this tab, is the display of SLAs both for NextGen time to conditional and Lenders initial assessment time frames.

The following is a guide for the SureScore rating system:

- Under 20%

- 21% to 40%

- 41% to 60%

- 61% to 80%

- 81% to 100%

It is very important to note, the SureScore is a guide only ! it does not guarantee that a lending application will be approved by the lender the loan application is submitted to.

To access more detailed training on SureScore, use this link to view the video training session: https://attendee.gotowebinar.com/recording/1215554511061370635

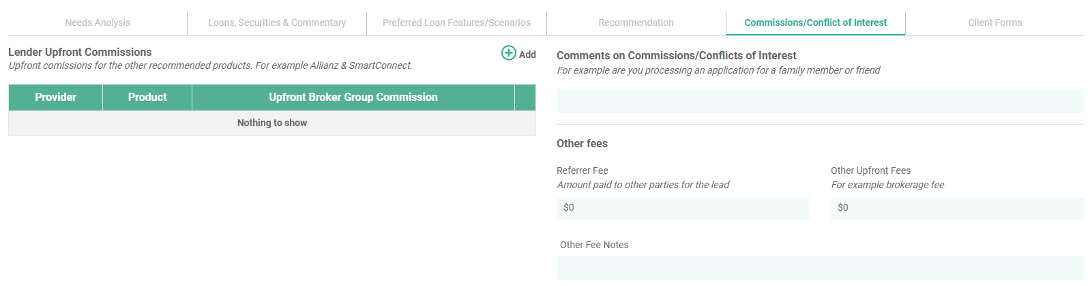

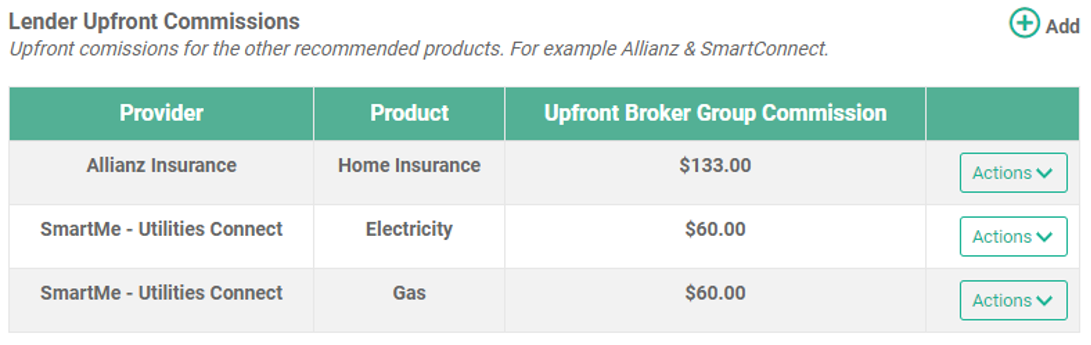

Commissions/Conflicts of Interest Tab:

This tab details the commissions payable to the Broker from other supplementary products or services offered (ie Property Referral Programs and other providers that will be available to you in the Services Store in Infynity)

Click on the Add button to add each provider, the product, and the anticipated Upfront Broker Group Commission that you will receive. Refer to the example below:

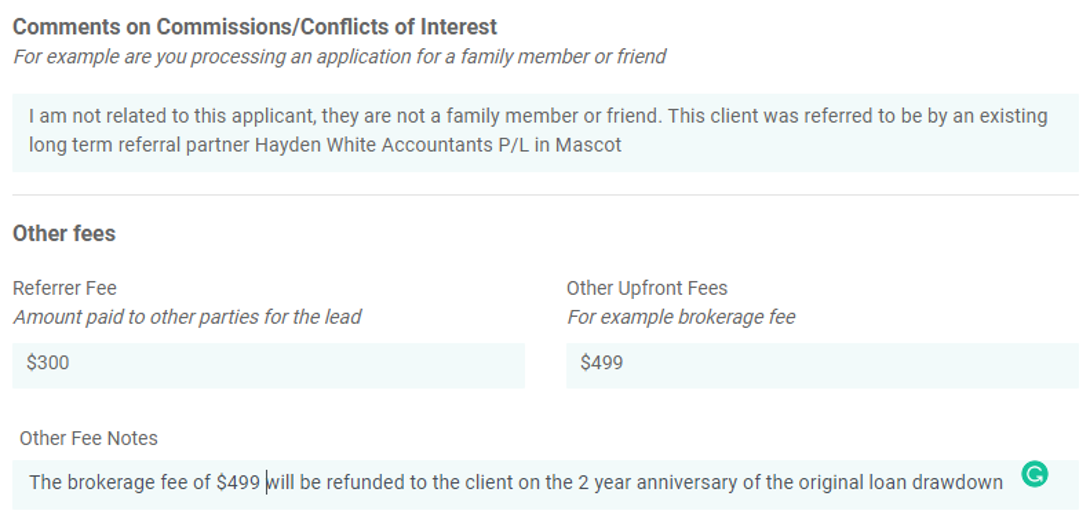

If you are processing an application for a family member or friend, you must detail this on the Lender Cover Sheet / Broker Notes to Lender Assessor.

It is best practice to also advice via email to the Lender BDM. Note: some lenders do not allow Brokers to process applications for family members.

Referrer fee amount must be detailed in this section - where a payment is being made to another party regardless of the amount for the lead.

Other upfront fees (ie Brokerage Fee) is to be completed and there is a section for you to make notes regarding fees. See the example below:

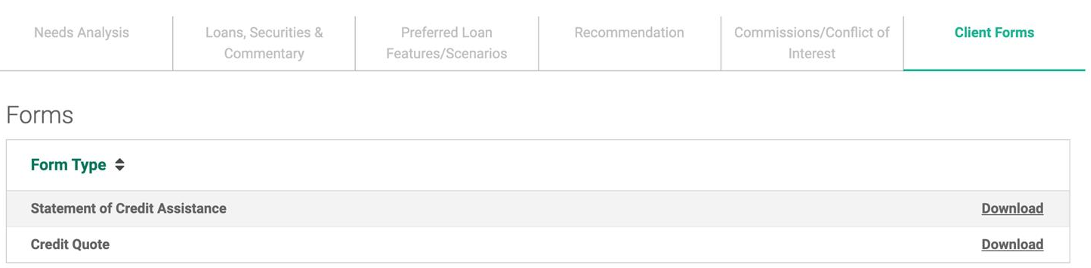

Client Forms Tab:

Your Statement of Customer Assistance (SOCA) is now complete and will be saved in the Client Forms Tab. This tab also has the Credit Quote, if you are charging your clients an upfront brokerage (or other) fee you are still required to have this signed and uploaded in the clients Infynity profile for Compliance