Settings

- Navigate

- Click on the content list below

to skip ahead to the different sections

on this page -

General Settings

-

Custom Fields

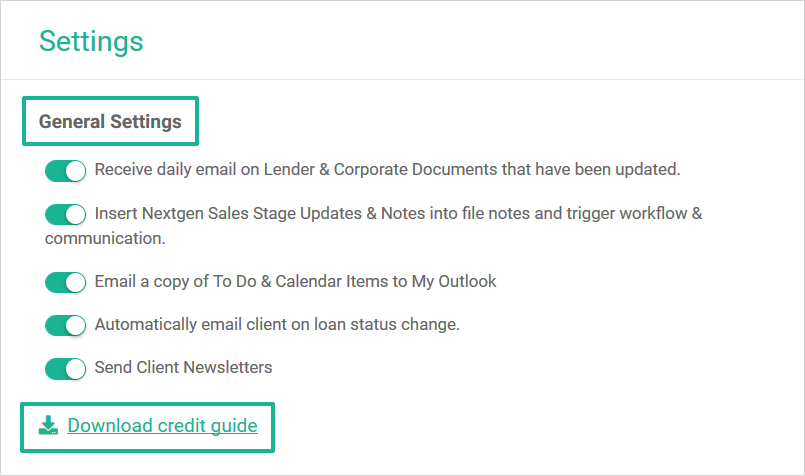

General Settings

On this Infynity page, you can manage settings your account on Infynity. You have access to the following general settings (slide the toggle bar to set to green and activate):

- Receive daily email (where applicable) on Lender and Finsure Documents that have been updated

- Insert Nextgen sales stage updates and notes (back channel messaging)

- Email a copy of your To-Do and Calendar Items to My Outlook

- Infynity to automatically email your client on each loan status change

- Infynity to send the client the automated bi-monthly Finsure Marketing Newsletters

- Download Credit Guide customised with your Broker details.

Note: point 3 in the Credit Guide refers to the top 6 lenders that Brokers across the entire Finsure group are utilising.

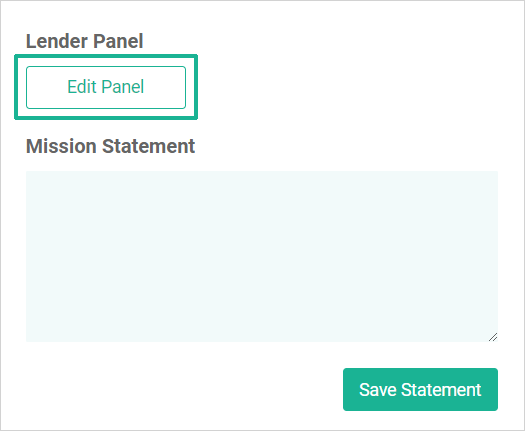

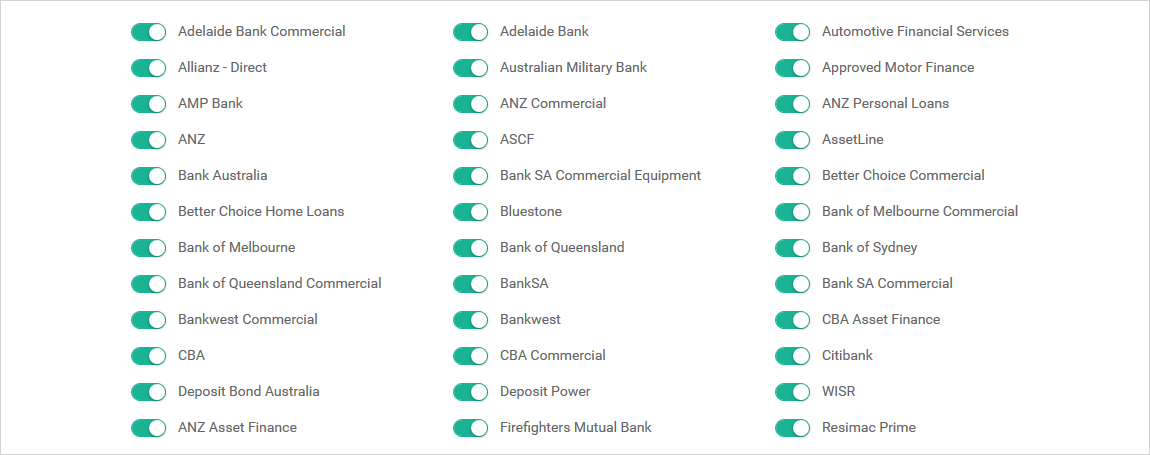

Also, on this page is a complete list of the Finsure Group Lender Panel – select with the toggle the Lenders and Service Providers that you are Accredited with as shown (otherwise they won’t be included in Quick Qualifier and Compare Products functions):

Note: the Mission Statement is there for you and your business. It will not be shared or displayed with your clients.

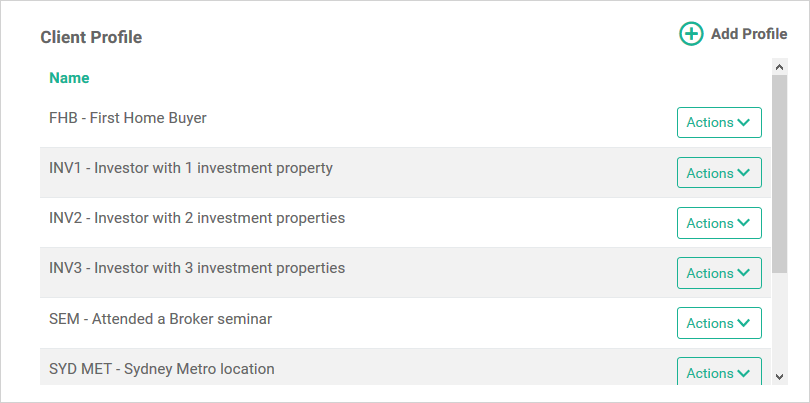

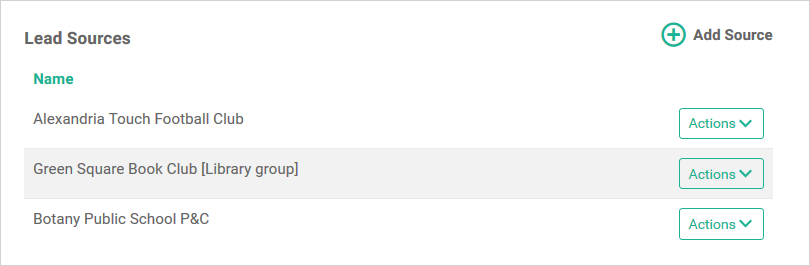

With the Client Profile and Lead Sources, these features will enable you to more accurately identify and target specific groups of clients within your database. Press 'Add Profile' to create Profiles unique to you and your client base, examples of some common profiles are shown below:

If you add your Lead Source, you will be able to run reporting to show which lead sources have generated business for and your business.

Custom Fields

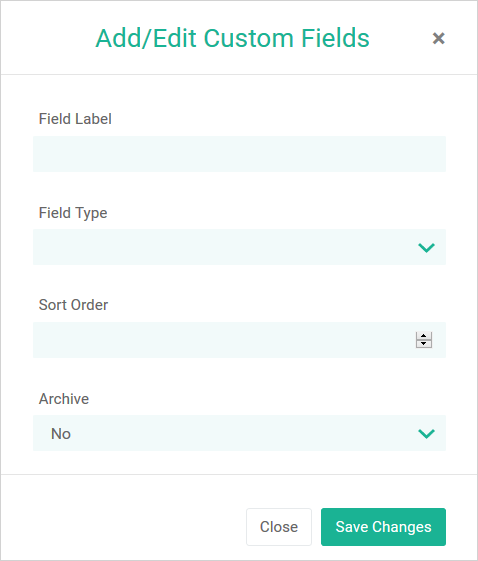

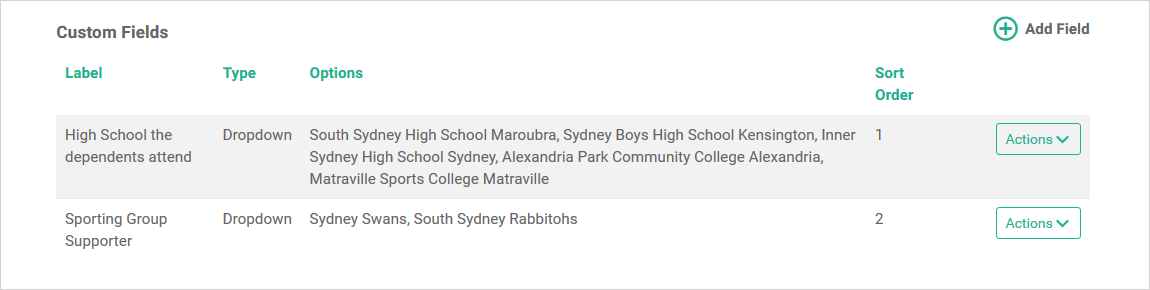

In this section create your more unique or custom fields such as sporting teams that your client follows as an example.

- Enter your Field Label

- Select the Field Type (Dropdown is popular)

- Enter your different Field Options

- Select the Sort Order for display of the custom fields

Other unique Custom Fields topics or themes could be:

- Investor Property location appetite (ie QLD; NSW; VIC)

- Current personal insurance products held (ie Life; Critical Illness; Mortgage Insurance)

- Current general insurance products held (ie Home Building; Contents; Landlord)